NACFB Funding Future Growth – Supporting brokers across London & the South East

Join us in London

Does your firm source finance for SME clients in London or the South East? Or are you looking to expand your brokerage’s reach in this region? Whether you’re an experienced operator or just seeking to learn more, the NACFB’s third Funding Future Growth event of 2025, held at London’s RSA House, is for you.

Due to overwhelming demand following a successful sold-out stop in London earlier this year, the NACFB has added an additional London date to its events calendar on Wednesday 10th September. Brokers are encouraged to register early to secure their spot, as spaces are limited to ensure meaningful connections are made. Booking priority is given to NACFB Member brokers. Please note, this is a broker-only event. Any NACFB lender Patrons interested in attending in a sponsorship capacity are asked to contact the events team.

What to expect…

Free for brokers to attend, including lunch and refreshments, the event brings together commercial intermediaries, lenders, suppliers and leading national trade bodies to explore growth opportunities for small businesses throughout London and the South East.. Here’s what you can expect from the session:

Agenda

09:30 – Registration and networking

Tea and coffee to be served

10:45 – Key address from the NACFB

With Jim Higginbotham

NACFB CEO Jim Higginbotham will kick off the session with an update from the NACFB. He will also share insights into our ongoing activities, key focuses, horizon planning and the central topics currently impacting the commercial finance community.

11:00 – Compliance and regulation update

With Sarah Cunningham

Sarah Cunningham, the NACFB’s head of compliance, will update the room on new requirements regarding commission disclosure and any further compliance updates affecting brokers and lenders in the room. This provides an opportunity to ask any questions and keep up to date on current affairs.

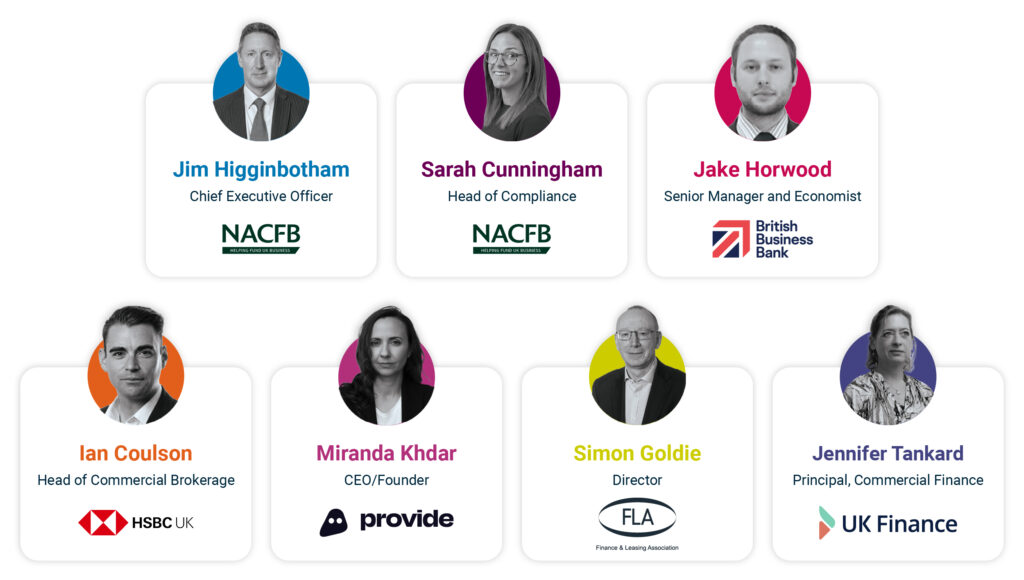

11:30 – Discussion and debate

Kieran Jones, Head of Comms and Advocacy, will host a panel of experts who will share regional insights. The panel session will feature Jake Horwood from the British Business Bank, Miranda Khdar from Provide Finance, Ian Coulson from HSBC, Jennifer Tankard from UK Finance, and Simon Goldie from the FLA. Crucial to sourcing appropriate funding solutions, brokers will be encouraged to participate, so come with questions!

11:15 – NACFB Partner session

Delegates will gain insight from Richard West, CEO of Red Flag Alert regarding the Red Flag Growth Score – the data behind it, how it works, and how brokers can use it to uncover high-potential clients hiding in plain sight.

12:00 – Lenders and suppliers

Representatives from selected lender Patrons Blackfinch Property, Credit4, Finance for Enterprise, Masthaven, Roma Finance, Signature Finance, TAB, and Time Finance will also be in attendance. Chosen for the value they add to the modern commercial finance broker, there will be plenty of time to meet and learn about their offerings. The lenders are particularly keen to find out more about your clients’ funding requirements, so do bring potential deals with you to chat through on the day.

12:15 – Lunch and a listening ear

Lunch is served. A further opportunity to network with brokers, lenders, panel experts and members of the NACFB team.

13:00 – Event concludes

Speakers

-

Ian CoulsonHead of Commercial Brokerage, HSBC

Ian CoulsonHead of Commercial Brokerage, HSBCA graduate of the University of Leicester, Ian has carried out a range of both client-facing and leadership roles over a 21 year career with HSBC. As the architect of HSBCs Commercial Broker proposition, Ian is passionate about developing teams and building mutually beneficial relationships that enable the generation of wealth and growth of the UK economy.

Originally form the North East, Ian lives in Warwickshire, is married with three children and enjoys fell walking and travelling (sometimes at the same time).

-

Jake HorwoodSenior Manager and Economist, British Business Bank

Jake HorwoodSenior Manager and Economist, British Business Bank -

Jennifer TankardPrincipal, Commercial Finance - UK Finance

Jennifer TankardPrincipal, Commercial Finance - UK FinanceJennifer Tankard, Principal, Commercial Finance, leads on policy and advocacy issues in relation to access to finance for SMEs, including Environment, Social and Governance (ESG) issues, supporting underserved markets and sector specific issues.

-

Jim HigginbothamCEO - NACFB

Jim HigginbothamCEO - NACFBJim Higginbotham, the newly appointed CEO of the NACFB, brings over 30 years of commercial finance expertise to the role. Most recently Group CEO at STAR Asset Finance, Jim led transformative growth, centralised operations, and reinforced risk management. His senior roles at Lombard, Barclays, and GE Capital have given him a broad industry perspective. Jim is dedicated to strengthening NACFB’s support for its Members and Patrons while championing professionalism and high standards across the UK’s commercial finance sector.

-

Kieran JonesHead of Communications & Advoacy, NACFB

Kieran JonesHead of Communications & Advoacy, NACFB -

Miranda KhdarCEO & Founder, Provide Finance

Miranda KhdarCEO & Founder, Provide Finance -

Richard WestManaging Director, Red Flag Alert

Richard WestManaging Director, Red Flag AlertRichard West is the Managing Director of Red Flag Alert. A UK leader in business data intelligence and analytics for predicting early warning signs of financial distress, insolvency and growth both domestically and internationally. The company has a strong focus on innovating how business data is delivered to businesses to make it both effective and actionable.

Red Flag Alert also offer intuitive global compliance and monitoring software that have been designed to fit seamlessly into process and not present an impediment to doing business. They recently secured £4.5 million in Series A investment, led by Foresight, and are strongly focused on growth; aiming to become the UK’s leading provider of business data intelligence and analytics to predict growth, global compliance risk and insolvency by 2025.

Richard joined the business in 2013 and has 15 years of experience in sales leadership, across three continents and has generated over £20,000,000 in recurring revenue. -

Sarah CunninghamHead of Compliance - NACFB

Sarah CunninghamHead of Compliance - NACFBSarah Cunningham, Head of Compliance and Assurance at the NACFB, Sarah has worked in Compliance for both lenders and brokers.

-

Simon GoldieDirector, Finance and Leasing Association

Simon GoldieDirector, Finance and Leasing AssociationSimon joined the Finance & Leasing Association (FLA) as their Head of Asset Finance in 2014. In 2021 he became Director of Business Finance & Advocacy. He is responsible for the FLA Asset Finance Division and the cross-organisational advocacy work that the FLA undertakes. This includes representing asset finance members to government and the regulators, developing relationships with stakeholders, overseeing the FLA’s asset finance policy work, and ensuring that we have a joined-up advocacy programme that demonstrates our members contribution to the UK, so that we can raise our profile and influence public policy. Simon’s background is in public affairs and communications. Previously, he worked for membership bodies and the commercial sector including the Chartered Institute of Taxation, the Association of Consultancy and Engineering, LexisNexis, and leading market research agencies. He has also been named one of the top 100 UK lobbyists. When he is not working, he raises, with his wife, two children and one cat.